Flexible digital lending platform helping innovative lenders evolve and thrive in the mobile and digital age

Financier™ is a scalable software solution giving financial and credit providers the efficiency, agility and autonomy required

to lend responsibly and ensure customers are treated fairly whilst helping to drive competitive advantage.

About Welcom

Simplifying business operations for better customer experiences and outcomes

Designing and developing software solutions since 1978, Welcom Digital has the in-house expertise to provide innovative and effective solutions to a broad spectrum of industries and customers.

Welcom Digital

Our Solutions

Financier™ Modules

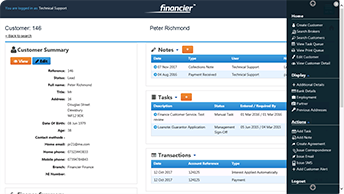

Highly configurable API first loan management system offering end to end suite of integrated modules covering most types of consumer and commercial lending and delivery channels

Websites / Portals

Expertise in delivering functionally rich ecommerce sites to integrated self-service portals and websites that can provide unique, personalised customer journeys

Special projects

Digital retail solutions covering the whole retail business process including flexible credit options, ecommerce, point of sale, stock, and financials

Professional Services

With a team of experts, we bring together a wealth of

experience in consultancy, solution design and development, integration, and support.

Project Management

From requirements capture to completion,

our

Project Managers ensure the smooth delivery of

projects, providing governance through our

dedicated Project Management Office.

Analysis & Consulting

Our Financier™ Business Analysts and Product Consultants are

experts in digital lending and can work with you

to translate

business and operational requirements so that lenders can safely

meet regulatory obligations whilst maximising profitability

Client Support

All our applications including in-house solutions,

hardware, databases, operating systems and

third party software are supported directly

through our dedicated Client Services team.

Why Choose Financier™?

Our multi-brand API first digital lending platform is a powerful solution that automates business processes and manages streamlined administration structures, allowing our clients more time to focus on good customer outcomes and meeting regulatory obligations.

Over £10 billion transacted through Financier

From smaller clients to FTSE100 companies

Digital lending capability for the FinTech sector

Our Insights

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 4565859

F 0845 4565253

Office hours9am to 5.30pm Mon to Fri