Consumer Finance

Financier™ provides an efficient and fully supported software solution for consumer finance

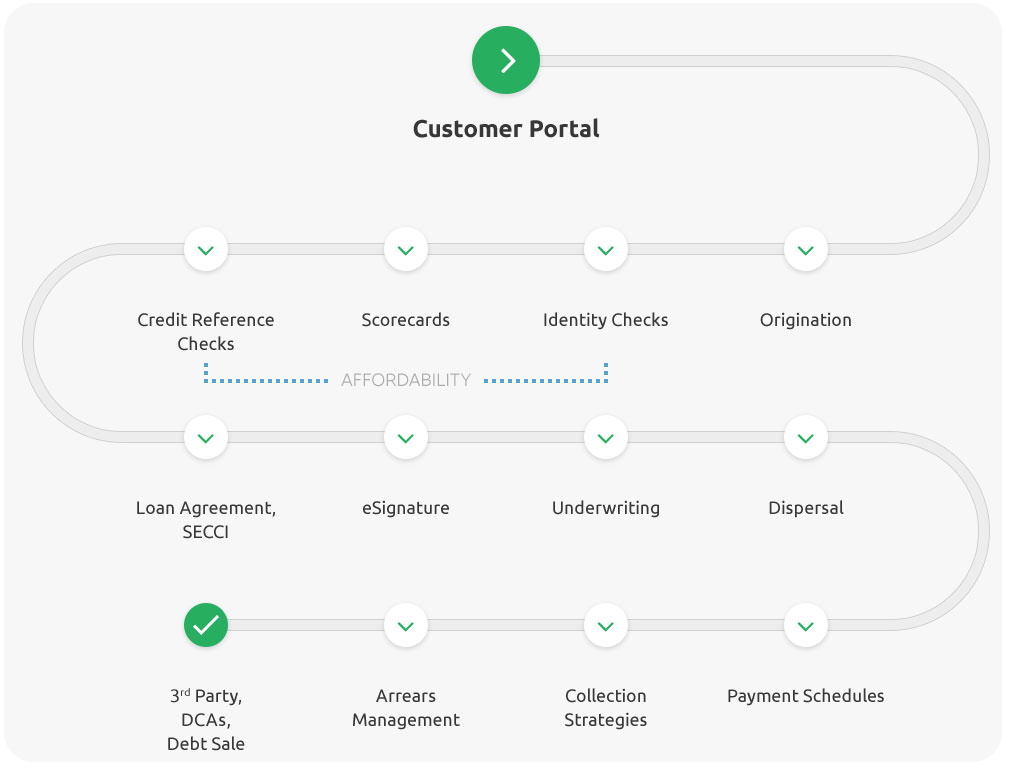

From origination through to collections and debt sale, we provide an end-to-end loan system software solution to lenders with Financier™

The digital journey at customer level enables the lender to provide personalised credit terms.

Our personal loan module is extremely flexible and scalable, and is developed to support the following loan types:

- Consumer loans

- Guarantor loans

- Secured loans

- Alternative finance

- Digital lending

- Marketplace loans

- Line of credit and overdraft facilities

- Short term loans

We can also provide website design and development including self-service portals for customers and intermediaries.

Our Insights

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 4565859

F 0845 4565253

Office hours9am to 5.30pm Mon to Fri