Overview

Assisting digital lenders provide personalised credit products via a web-based digital lending platform.

Welcom provide flexible lending and collection solutions for both commercial and consumer finance with our leading enterprise platform, Financier. Our clients range from high street names offering retail finance (revolving credit/term loans), and providers of short or long term credit to peer to peer platforms.

Financier’s unique modular system allows you to rapidly deliver new products to your chosen market, whether consumer or commercial, regulated or unregulated agreements

Our Solutions

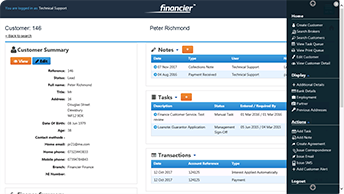

Financier™

Highly configurable loan management platform offering end to end suite of integrated modules covering most types of lending and delivery channels

Websites / Portals

Expertise in delivering functionally rich ecommerce sites to integrated self-service portals and websites

Special projects

Digital retail solutions covering the whole retail business process including flexible credit options, ecommerce, point of sale, stock and financials

Our Insights

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 4565859

F 0845 4565253

Office hours9am to 5.30pm Mon to Fri