Whitecap Consulting estimates the growing FinTech sector in the North of England is now adding £5 billion per year to the regional economy, set to rise to £6 billion by 2030.

The report finds the North to have close to 400 FinTech firms employing nearly 20,000 people, generating £1.5 billion of Gross Value Added (GVA) to the northern economy. It estimates the total FinTech workforce of the region to be almost 70,000 people, when FinTech roles within the financial and tech sector firms are included.

Home to 15 million people – more than 20% of the UK’s population – with an 8 million strong workforce generating £344 billion in GVA, the North of England has long been recognised as an important economic region. It is also home to 42 universities and approximately 100 further and higher education colleges, with a combined 1.35 million students.

In addition to laying out a series of recommendations for key stakeholders across the public, private and education sectors, the report identifies five ‘big ideas’ that could significantly accelerate the growth of the sector and increase its national and international significance. These include proposing pan-northern initiatives including a FinTech Accelerator, FinTech Investment Fund, FinTech Innovation Challenge, FinTech Placements Programme, and Financial Services Reskilling Programme.

The report defines a FinTech firm as an organisation whose primary business model is the application of technology to deliver financial products or services, and analyses the distribution of these firms across the three main regions of the North, finding 58% of FinTech firms are based in the North West, 30% in Yorkshire & Humber, and 12% in the North East. Data is also presented across the Combined Authority regions of the North, confirming that the four main clusters are found in Greater Manchester (175 FinTech firms), West Yorkshire (94), Liverpool City Region (44), and the North East (44).

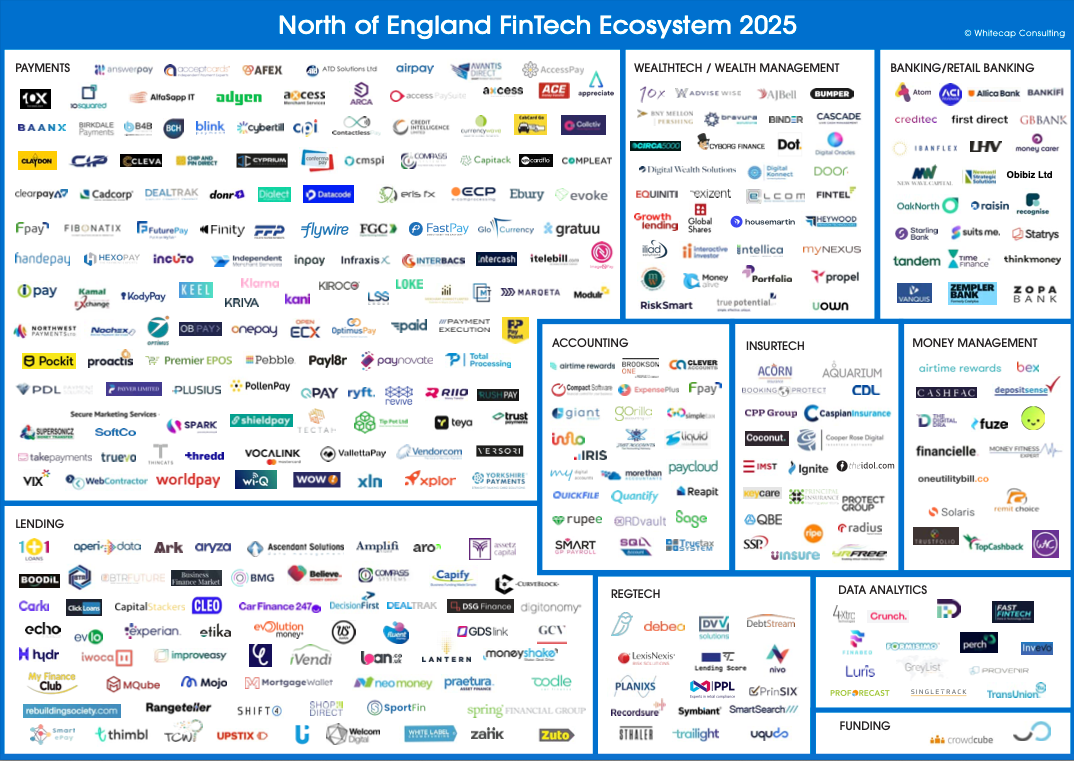

Additionally, the FinTech sector in the North is broken down into granular detail, with Payments, Banking, Lending and WealthTech found to be the most prominent sub-sectors. The average age of FinTech firm is approaching 13 years, with founders averaging 37 years old when they created the business. A lack of diversity of founders is identified, with only 6% of founders being female, although a more encouraging datapoint is that 38% of directors of FinTech firms are female.

The report is the output of a project over recent months, including a programme of data analysis and research, and a series of regional discussion groups across Manchester, Leeds, Liverpool and Newcastle. This collaborative project has been conducted in partnership with regional and national organisations including Aviva, Bruntwood SciTech, FCamara, FinTech North, Innovate Finance, Liverpool City Region Combined Authority, MIDAS (Manchester’s Inward Investment Agency), Mastercard, NatWest Group, Northern Powerhouse Partnership, North East Combined Authority, PEXA, Pulsant, RSM, West Yorkshire Combined Authority.

The new report builds on previous reports published by Whitecap, which analysed the FinTech ecosystems in the North East, Leeds City Region, Greater Manchester, and Liverpool City Region.

The full report can be found here: North of England FinTech Report 2025

Source: Whitecap

British consumers most likely to demand instant decisions on loans

New research by CRIF has found that consumers in the UK are the most likely in Europe to demand near-immediate decision-making on services and product applications by banks, insurers and lenders.

Mortgage arrears increases by 18%

Latest mortgage lending data from the Bank of England and FCA shows that the value of outstanding mortgage balances with arrears is 18% higher than a year earlier and has risen to £21.9 billion, albeit this has declined by 0.4% compared to the previous quarter.

Business confidence hits two year low

UK business confidence has reached its lowest point in nearly two years, according to the latest Business Trends Report by BDO. The BDO optimism index fell by 5.81 points to 93.49 in November, marking the steepest month-on-month decline since 2021. Firms are grappling with rising costs, reduced customer confidence, and falling orders, leading to a potential economic contraction.

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 4565859

F 0845 4565253

Office hours9am to 5.30pm Mon to Fri