Credit card spending slows

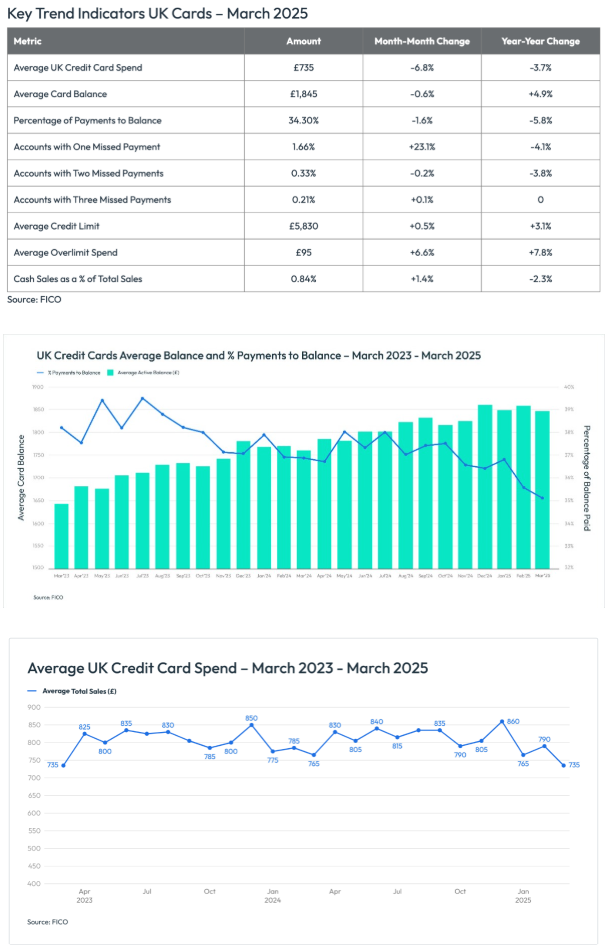

Latest UK credit card data from global analytics software leader FICO provides stark evidence that consumer financial confidence remains low. Whilst spending has followed the usual seasonal drop after Easter, the average active balance is 4.7% higher year-on-year, suggesting consumers are not able to clear as much of their credit card debt.

The percentage of balance paid is also trending downwards year-on-year by 5.8%. Another critical sign of financial difficulty is the percentage of customers using credit cards to take out cash, which has increased month-on-month by 2.5%.

Spending fell by 4.1% month-on-month and 1.7% year-on-year, whilst balances fell slightly compared to April, to £1,865, but remain 4.7% higher year-on-year.

The percentage of overall balance paid has increased by 4.7% month-on-month to 35.6%, but is 5.8% lower year-on-year.

Year-on-year, missed payments have fallen across all delinquency periods. The average balance on one missed payment account has increased 2.4% compared to April and 7.2% year-on-year.

Customers using credit cards to take out cash increased for the second month in a row, by 2.5%.

FICO says that sales tend to decrease after the Easter holidays, and FICO data shows that May 2025 was no exception. Spending fell by 4.1% month-on-month and 1.7% year-on-year, to an average of £790. However, with the percentage of overall balance paid dropping by 5.8% year-on-year, balances have risen by 4.7% compared to May 2024, which will be a concern for lenders.

Lenders will also want to keep a close eye on delinquencies, as May saw the erratic patterns of 2025 continuing. After the significant 22.1% drop in April 2025, May saw a 10.4% increase in the percentage of customers missing one payment. Year-on-year, there has been a 12.4% decrease. For customers missing two payments, there has been a 9.6% decrease month-on-month and 8.1% year-on-year. However, the percentage of customers missing three payments increased month-on-month by 3.9%.

When comparing the ratio of the average delinquent balance to the overall balance, this ratio is slightly trending upwards, indicating that missed payment balances are increasing at a faster rate. Lenders may wish to review balance segmentation in risk strategies, as goods and services that cost £2,000 in 2020 would cost £2,350 today. They may also want to consider adopting or reviewing pre-delinquency strategies in order to identify and proactively act on customers before they get into financial trouble.

Source: Credit Connect

Economic growth forecast slashed for 2025

The EY ITEM Club Winter Forecast is predicting that UK GDP growth will be at 1% in 2025, down from the 1.5% growth projected in October’s forecast. This represents only a marginal improvement on the 0.8% GDP growth the UK economy likely achieved in 2024.

Consumer finance new business fell by 1% in November 2024

New figures released by the Finance & Leasing Association (FLA) show that consumer finance new business fell in November 2024 by 1% compared with the same month in 2023. In the eleven months to November 2024, new business in this market was 1% higher than in the same period in 2023.

Eight in ten mortgage brokers optimistic amid economic challenges

New research reveals that there is healthy optimism among brokers about the future of the UK mortgage sector, despite a challenging economic backdrop, including stamp duty rises expected in April and falling rent prices causing worries for buy-to-let buyers.

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 456 5859