Commenting on the latest new business figures for the second charge mortgage market, Fiona Hoyle, Director of Consumer & Mortgage Finance and Inclusion at the Finance & Leasing Association (FLA), said:

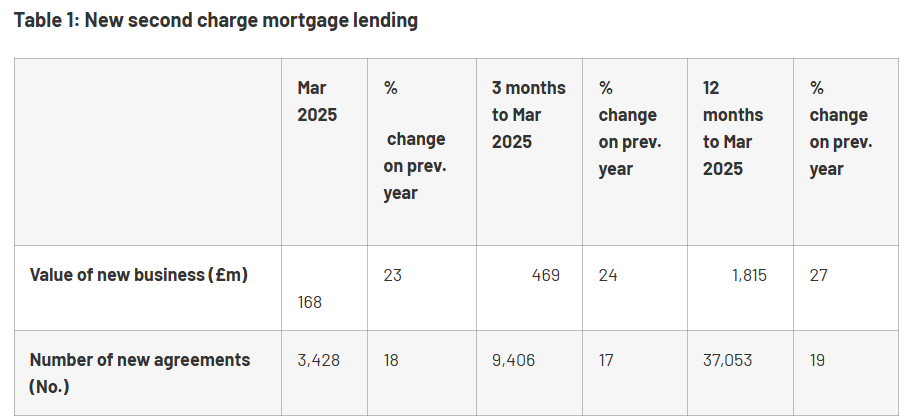

“The second charge mortgage market reported a strong end to the first quarter of 2025, with new business volumes up by 17% in Q1 2025 as a whole.

“The distribution of new business by purpose of loan in Q1 2025 showed that the proportion of new agreements which were for the consolidation of existing loans was 58.0%; for home improvements and the consolidation of existing loans was 22.6%; and for home improvements only was 11.8%.

“As always, customers who are concerned about meeting payments should speak to their lender as soon as possible to find a solution.”

Source: FLA

British consumers most likely to demand instant decisions on loans

New research by CRIF has found that consumers in the UK are the most likely in Europe to demand near-immediate decision-making on services and product applications by banks, insurers and lenders.

Mortgage arrears increases by 18%

Latest mortgage lending data from the Bank of England and FCA shows that the value of outstanding mortgage balances with arrears is 18% higher than a year earlier and has risen to £21.9 billion, albeit this has declined by 0.4% compared to the previous quarter.

Business confidence hits two year low

UK business confidence has reached its lowest point in nearly two years, according to the latest Business Trends Report by BDO. The BDO optimism index fell by 5.81 points to 93.49 in November, marking the steepest month-on-month decline since 2021. Firms are grappling with rising costs, reduced customer confidence, and falling orders, leading to a potential economic contraction.

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 4565859

F 0845 4565253

Office hours9am to 5.30pm Mon to Fri